Blogs & Insights

Stay informed with our latest articles on Bitcoin and other insights

Stay informed with our latest insights

Choosing the right loan type to match your goals, timeline, and risk comfort.

If you’ve used Spark swaps or traded BTKN tokens, you’ve already interacted with Bitcoin’s UTXO model—even if you didn’t know it.

When you borrow against your bitcoin, one question matters more than most: Who actually controls your coins while the loan is active?

Discover more insights and stories

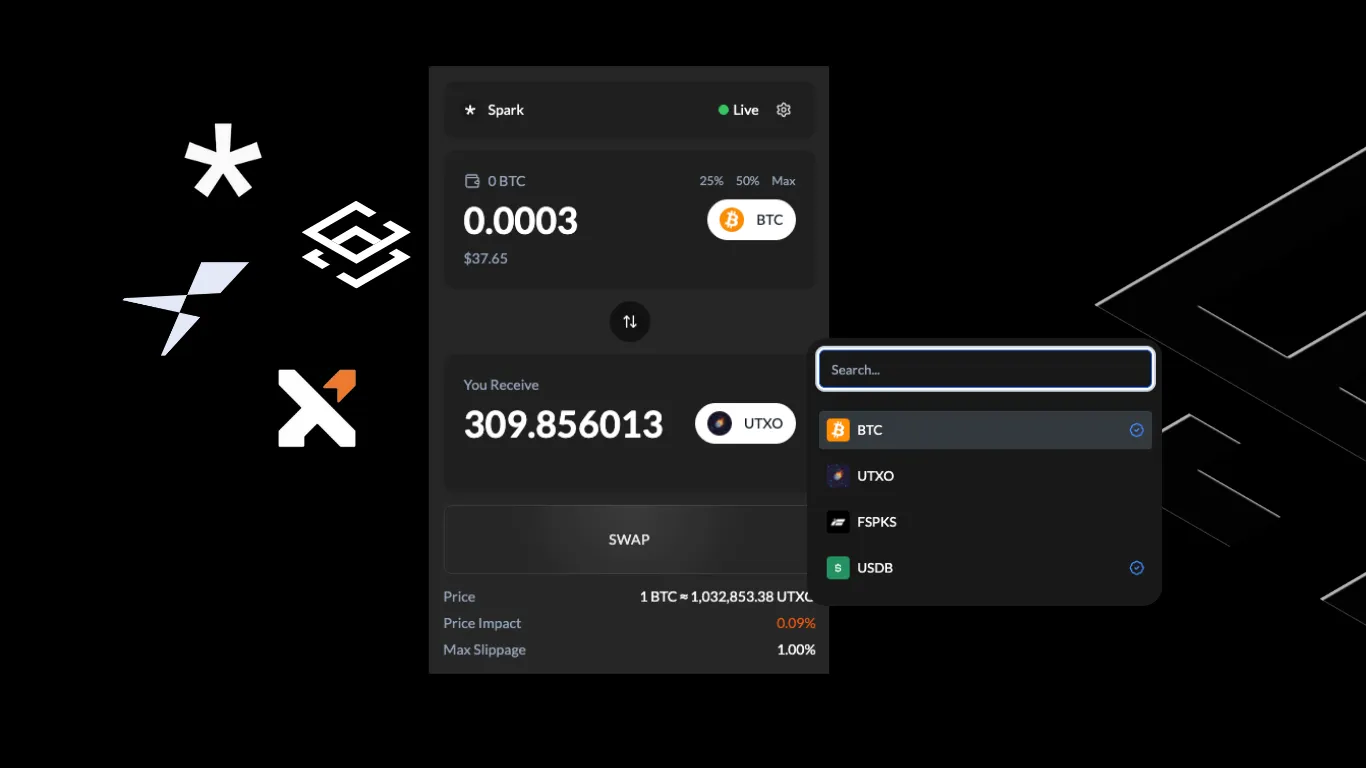

Now that Spark swaps are available on Sats Terminal, anyone can connect their wallet, compare best-execution routes, and complete a swap that settles back to Bitcoin L1 in seconds.

Borrowing against your bitcoin can unlock liquidity without selling your stack, but it can also introduce risk.

Let’s say you’ve been holding bitcoin for years. You believe in it long-term, but right now you could use a bit of liquidity. Maybe for taxes, a project, or just some breathing room.

What if you could unlock the value of your bitcoin without ever selling it? That’s exactly what bitcoin-backed loans make possible.

Did you know a bitcoin loan isn’t just about getting quick cash? It’s a way to access liquidity with your bitcoin without selling, and it has more use cases than most people expect.

Picking between the DeFi and CeFi is all about how much control, risk, and effort you’re willing to trade for easy cash. In this post we breakdown the biggest differences between the two and help you choose the right loan offer that suits your risk profile.

Say hello to the fastest, smoothest way to trade BKTN tokens secured by Bitcoin, directly from your Xverse Spark Wallet. Developed in collaboration with Flashnet, Spark, and Xverse.

Today we’re excited to announce the beta launch of Borrow, our new bitcoin loan product. It’s the simplest, most transparent way to borrow against your bitcoin.

Bitcoin-native token trading, finally — seamless, secure, and instant.

Learn how to unlock liquidity from your Bitcoin in 2025, without selling, by navigating today’s best loan rates, collateral requirements, and smart strategies for borrowing safely.

The cryptocurrency lending landscape has undergone a dramatic transformation in 2025, with Decentralized Finance (DeFi) protocols surging ahead of their Centralized Finance (CeFi) counterparts. DeFi lending has achieved an unprecedented 959% growth to $19.1 billion by Q4 2024, while CeFi platforms struggle to rebuild trust after major collapses. This comprehensive analysis examines the security frameworks, transparency mechanisms, and yield opportunities that define both lending models, providing essential insights for investors navigating the evolving world of Bitcoin-backed loans in 2025.

Bitcoin-collateralized loan rates are quietly trending lower in 2025. Competition has intensified, institutional liquidity has deepened, and risk management has matured—creating a borrower’s market across much of the secured (over-collateralized) segment. Unchained’s recent milestone—surpassing $1 billion in bitcoin-backed loan originations—arrived alongside an APR reduction. Together, these shifts signal a new phase for BTC credit markets: safer custody, clearer pricing, and better terms for long-term holders who prefer borrowing to selling.

A Bitcoin‑collateral loan lets you borrow cash or stablecoins without selling your BTC. Done well, it can unlock real estate deals, slash expensive debt, fund a growing business, add trading firepower, or smooth big life expenses—all while preserving long‑term exposure to Bitcoin. Done poorly, volatility can force margin calls or liquidations. This guide shows you how to do it right.

Curious about earning interest on your Bitcoin or getting a loan without selling your BTC? This beginner-friendly guide compares the top crypto lending platforms in 2025 – from DeFi protocols like Aave and Morpho to CeFi services like Nexo and Ledn. We’ll break down their interest rates, fees, collateral requirements, security, and ease of use. Read on to discover which Bitcoin lending platform best fits your needs.

Discover how you can unlock the liquidity of your idle Bitcoin holdings without selling your crypto assets. Learn about innovative platforms and methods that let you access funds while maintaining your Bitcoin's long-term value.

Bitcoin-backed loans have steadily gained traction in recent years as cryptocurrency adoption continues to grow. By allowing individuals to leverage their Bitcoin holdings without selling them, these loans offer liquidity while potentially maintaining the upside of future BTC appreciation. In this article, we'll dive deep into how Bitcoin-backed loans work in 2025, including collateral requirements, interest rates, advantages, and inherent risks.