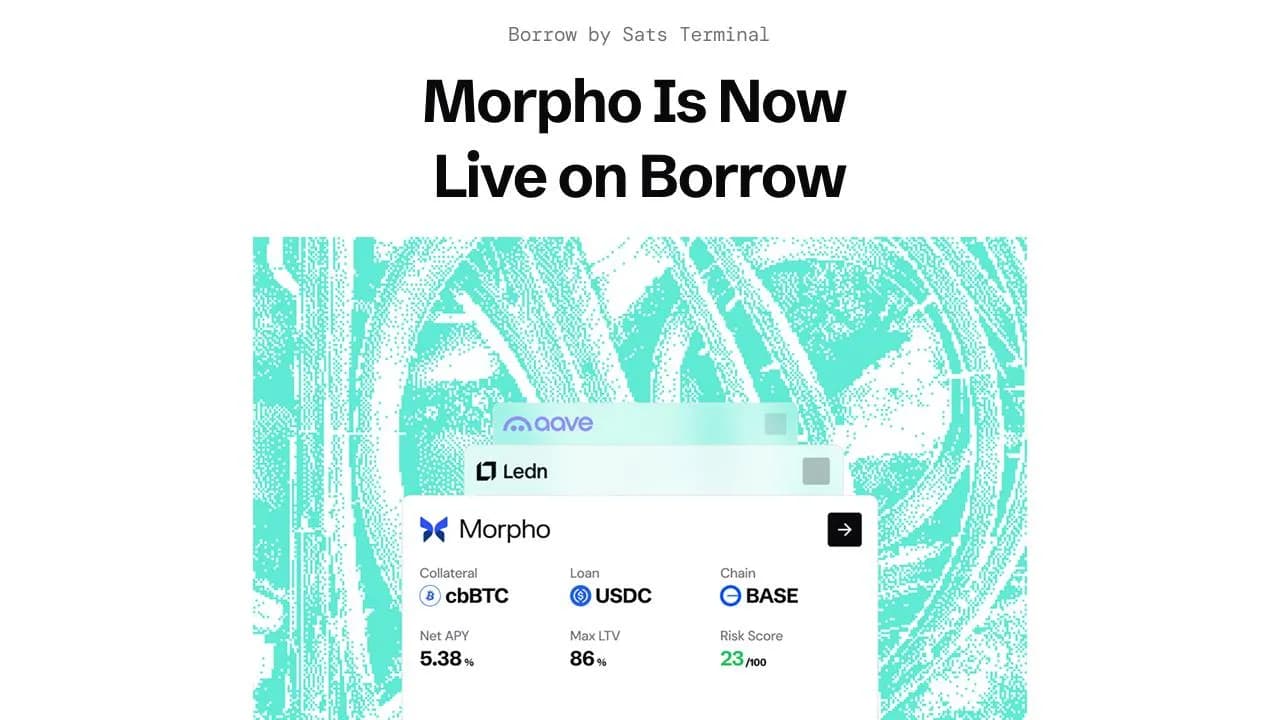

Morpho Is Now Live on Borrow by Sats Terminal

More choice, better rates: Morpho liquidity is now available through Borrow.

TL;DR

What’s new: Borrow by Sats Terminal now supports DeFi borrowing via Morpho.

Why it matters: Morpho is already used at scale across major integrations, giving Borrow users access to proven DeFi lending liquidity without needing to navigate DeFi tools directly.

How it works: Your bitcoin is wrapped and used as collateral on Morpho, with USDC borrowed directly from the protocol through Borrow’s guided, wallet-first flow.

We’re excited to announce that Morpho is now live on Borrow by Sats Terminal!

This integration adds Morpho as a new DeFi borrowing option within Borrow, giving you another transparent way to access stablecoin liquidity using bitcoin as collateral, all through a single, wallet-first interface.

What the Morpho integration unlocks

Bitcoin-backed borrowing has traditionally been fragmented. Users often had to choose between centralized lenders with opaque terms, or DeFi protocols that required navigating unfamiliar tools, wrapped assets, and multiple steps.

With Morpho integrated into Borrow, you can now access DeFi borrowing alongside other borrowing options, with clear visibility into loan terms before committing.

From one interface, you can review key details such as:

loan-to-value (LTV)

interest rates and fees

collateral requirements

liquidation parameters

All confirmations happen directly from your wallet, with no custody taken by Sats Terminal.

How the Morpho integration works

When borrowing via Morpho on Sats Terminal:

Your bitcoin is wrapped and bridged to EVM

The wrapped BTC is used as collateral on Morpho

You receive USDC directly from the Morpho protocol

All of this is handled through Borrow’s guided flow, so you don’t need to manage bridging, contract interactions, or protocol-specific steps yourself.

Supported network: The Morpho integration on Borrow currently supports Base.

Sats Terminal remains non-custodial at the interface. You sign transactions from your wallet, while the borrowing logic is executed directly with the underlying protocol.

Why Morpho

Launched in 2022, Morpho has quickly become one of the most widely used lending protocols in DeFi. At the time of writing, it leads DeFi lending by monthly active users, accounting for 44% of MAU share, and secures several billions of dollars in total value locked (TVL), reflecting broad, real-world usage.

Morpho is designed to run decentralized finance in the background, while users interact through familiar, intuitive interfaces. As a result, millions of users access Morpho through large-scale integrations without needing to engage directly with DeFi mechanics.

Recent milestones highlight Morpho’s scale and trust:

#1 DeFi lending protocol by monthly active users (44% MAU share)

$1B+ in active loans via the Coinbase integration, with nearly $500M in USDC earning yield

User growth from 67,000 to 1.4M users in 2025 alone

By integrating Morpho into Borrow, we’re adding a DeFi lending layer that is already proven at scale, while preserving a clear, wallet-first, non-custodial borrowing experience for bitcoin holders.

This integration reflects how the market operates today: supporting bitcoin-native flows where possible, and wrapped BTC where required, while making the trade-offs explicit.

One interface, clearer choices

With Morpho live on Borrow, you can now:

compare DeFi borrowing options in one place

review terms before signing

borrow without selling your bitcoin

remain in control of your keys throughout

More DeFi borrowing integrations are coming soon.

Get started

Explore the Morpho integration today on Borrow by Sats Terminal. Compare options, review terms, and borrow with no KYC.

Disclaimer

This post is for informational purposes only and does not constitute financial, legal, or tax advice. Borrowing involves risk, including potential liquidation or loss of funds. Rates and terms are variable. Sats Terminal is non-custodial at the interface; underlying protocols may involve additional risks. Users are responsible for compliance with local regulations.